Not known Details About Pvm Accounting

Not known Details About Pvm Accounting

Blog Article

The Best Strategy To Use For Pvm Accounting

Table of ContentsNot known Facts About Pvm AccountingNot known Facts About Pvm AccountingAbout Pvm AccountingAn Unbiased View of Pvm AccountingPvm Accounting Can Be Fun For AnyoneSome Of Pvm Accounting

Oversee and deal with the development and authorization of all project-related billings to consumers to foster great communication and prevent concerns. financial reports. Guarantee that appropriate reports and paperwork are submitted to and are updated with the IRS. Ensure that the accountancy procedure abides by the legislation. Apply called for construction accountancy criteria and procedures to the recording and reporting of building task.Interact with numerous financing companies (i.e. Title Firm, Escrow Company) concerning the pay application procedure and requirements required for settlement. Assist with implementing and keeping internal economic controls and procedures.

The above statements are intended to explain the basic nature and degree of job being carried out by people designated to this classification. They are not to be taken as an extensive listing of duties, obligations, and skills needed. Workers may be required to execute tasks outside of their typical responsibilities from time to time, as needed.

The Main Principles Of Pvm Accounting

You will certainly assist sustain the Accel team to make sure delivery of successful on schedule, on budget, jobs. Accel is seeking a Building and construction Accountant for the Chicago Office. The Building and construction Accounting professional carries out a variety of audit, insurance conformity, and project administration. Functions both independently and within particular divisions to preserve economic documents and make particular that all documents are kept current.

Principal duties include, but are not limited to, managing all accounting functions of the firm in a prompt and accurate manner and offering records and schedules to the company's CPA Firm in the preparation of all financial declarations. Ensures that all accounting treatments and features are taken care of precisely. Responsible for all economic documents, pay-roll, banking and everyday operation of the audit feature.

Prepares bi-weekly test balance records. Works with Task Managers to prepare and upload all monthly invoices. Processes and problems all accounts payable and subcontractor repayments. Creates month-to-month wrap-ups for Workers Settlement and General Liability insurance premiums. Produces monthly Job Expense to Date reports and functioning with PMs to integrate with Task Supervisors' allocate each job.

10 Simple Techniques For Pvm Accounting

Efficiency in Sage 300 Construction and Property (formerly Sage Timberline Office) and Procore building management software program an and also. https://www.goodreads.com/user/show/178444656-leonel-centeno. Should likewise be efficient in various other computer system software program systems for the prep work of records, spreadsheets and various other audit analysis that may be required by monitoring. construction taxes. Need to possess solid business abilities and capability to prioritize

They are the monetary custodians who make sure that building and construction tasks remain on spending plan, abide by tax obligation guidelines, and preserve economic transparency. Construction accounting professionals are not just number crunchers; they are strategic companions in the building process. Their key role is to take care of the financial facets of construction tasks, making certain that resources are assigned effectively and economic dangers are decreased.

The Single Strategy To Use For Pvm Accounting

They function very closely with job supervisors to develop and monitor budget plans, track costs, and forecast monetary demands. By keeping a limited grasp on task funds, accounting professionals aid protect against overspending and economic setbacks. Budgeting is a cornerstone of successful building tasks, and building and construction accountants are important hereof. They create in-depth spending plans that include all project costs, from products and labor to licenses and insurance policy.

Navigating the facility web of tax obligation policies in the building industry can be tough. Building accounting professionals are well-versed in these guidelines and ensure that the job follows all tax needs. This includes managing payroll taxes, sales taxes, and any type of various other tax commitments particular to building and construction. To excel in the function of a building accounting professional, people need a solid instructional foundation in accounting and money.

Furthermore, qualifications such as State-licensed accountant (CERTIFIED PUBLIC ACCOUNTANT) or Licensed Building Industry Financial Specialist (CCIFP) are highly concerned in the industry. Working as an accounting professional in the construction industry includes an one-of-a-kind set of difficulties. Building and construction jobs often entail limited deadlines, changing policies, and unforeseen expenses. Accountants need to adjust quickly to these challenges to maintain the job's financial wellness intact.

Not known Facts About Pvm Accounting

Specialist qualifications like CPA or CCIFP are additionally extremely advised to show experience in building and construction audit. Ans: Building and construction accountants create and check spending plans, determining cost-saving opportunities and ensuring that the task stays within budget plan. They likewise track expenses and projection economic requirements to avoid overspending. Ans: Yes, building and construction accountants take care of tax conformity for building and construction tasks.

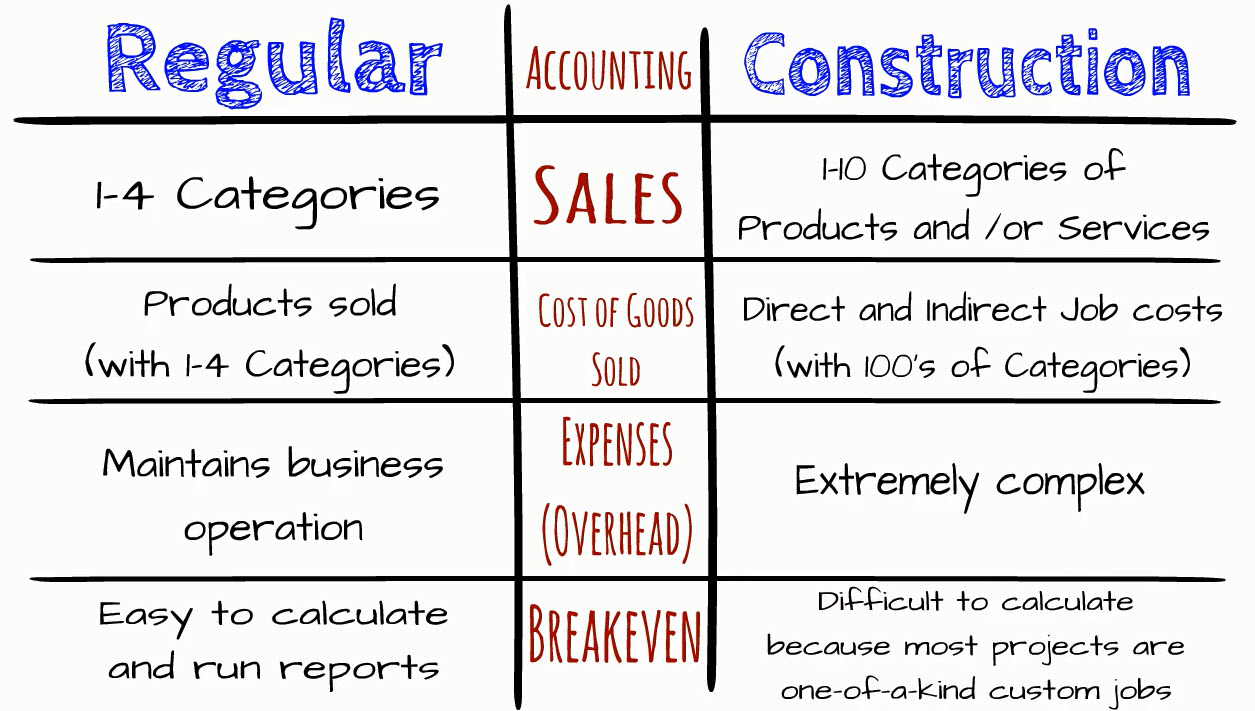

Introduction to Building Bookkeeping By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building and construction companies have to make difficult selections amongst several economic options, like bidding on one task over one more, selecting financing for products or tools, or setting a job's earnings margin. On top of that, building is a notoriously volatile market with a high failure rate, slow time to payment, and irregular capital.

Manufacturing includes repeated procedures with conveniently identifiable costs. Manufacturing calls for different processes, products, and equipment with varying expenses. Each project takes area in a new location with differing site problems and special difficulties.

The Best Guide To Pvm Accounting

Lasting connections with vendors reduce settlements more information and enhance efficiency. Irregular. Regular usage of different specialty specialists and distributors influences performance and cash money flow. No retainage. Payment gets here completely or with normal payments for the full agreement amount. Retainage. Some part of repayment might be withheld up until task conclusion even when the service provider's job is completed.

Normal manufacturing and temporary agreements result in convenient capital cycles. Uneven. Retainage, slow-moving settlements, and high ahead of time expenses result in long, uneven cash money circulation cycles - construction accounting. While traditional manufacturers have the advantage of regulated environments and maximized production procedures, construction business must regularly adjust per brand-new project. Even rather repeatable projects need adjustments due to site conditions and various other variables.

Report this page